does cash app report to irs for personal use

Does the cash app report personal accounts to IRS. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS.

Does Cash App Report Personal Accounts To Irs Get More Updates

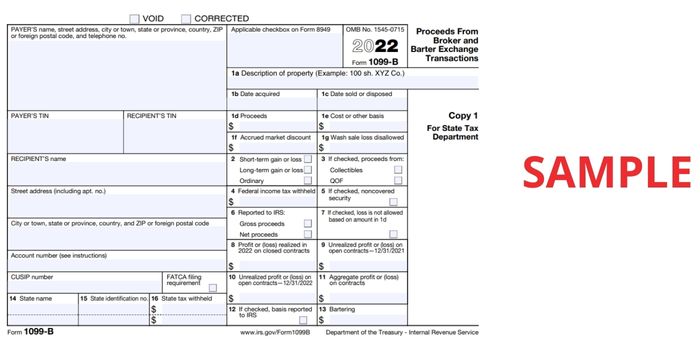

Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS.

. You are federally required to report that money as taxable income. Log in to your Cash App Dashboard on web to download your forms. IRS Tax Tip 2019-49 April 29 2019 Federal law requires a person to report cash transactions of more than 10000 to the IRS.

If you have a standard non-business Cash App account you dont need to worry about Form 1099-K. Any errors in information will hinder the direct deposit. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS.

The answer is very simple. Therefore the new law also does not apply to other apps like Venmo or Cash App. As well as stolen.

Only customers with a. Certain Cash App accounts will receive tax forms for the 2021 tax year. IRS would not tax any transfers that take place between friends and family members.

As of January 1 the IRS will change the way it taxes income made by businesses that use Venmo Zelle Cash App and other payment apps to receive money in. A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account. Before the new rule business transactions were only reported if.

Cash App wont report any of your personal transactions to the IRS. The new cash app regulation isnt a new tax. So if you SELL items online and use these cash transferring platforms you must provide the IRS with receipts.

Previous rules for third-party payment systems. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the. Nothing to do with the transfer method currency etc.

Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS. Cash App wont report any of your personal transactions to the IRS. Here are some facts about reporting these.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. Cash App Support Tax Reporting for Cash App. Cash App is required.

For this reason it is recommended that you set up separate cash apps for business and personal use. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others.

.jpeg)

How To Do Your Cash App Taxes Coinledger

Can Cash App Be Traced Need To Know

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York

Cash App Taxes Review 2022 Online Tax Software With No Fees Ever Cnet

How To Easily File Your Cash App 1099 Taxes Step By Step

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

Cash App Taxes Review 2022 Online Tax Software With No Fees Ever Cnet

Income Reporting How To Avoid Undue Taxes While Using Cash App

Cash App Taxes Review 2022 Formerly Credit Karma Tax

Cash App Taxes 100 Free Tax Filing For Federal State

Does The Irs Want To Tax Your Venmo Not Exactly

Does Cash App Report Your Personal Account To Irs

Does The Irs Want To Tax Your Venmo Not Exactly

Don T Believe The Hype Biden S 600 Tax Plan Won T Force You To Report All Venmo Transactions To The Irs

What S New For Family Child Care Providers Who Use Electronic Payment Apps Taking Care Of Business

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Can You Track Your Cash App Card Is Cash App Traceable Frugal Living Coupons And Free Stuff

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

:max_bytes(150000):strip_icc()/CashAppTaxes-0f07d3b137894278bb44fb3f330bd7c3.jpeg)